arkansas estate tax statute

2 on taxable income from 5000 to 9999 for taxpayers with net income of 84500 or less and on the first 4300 of net income for. When a property owner fails to timely pay the assessed tax the property may become subject.

Property Tax Calculator Estimator For Real Estate And Homes

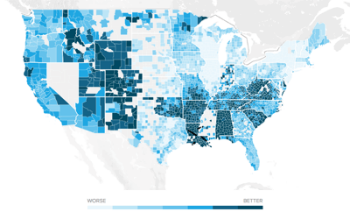

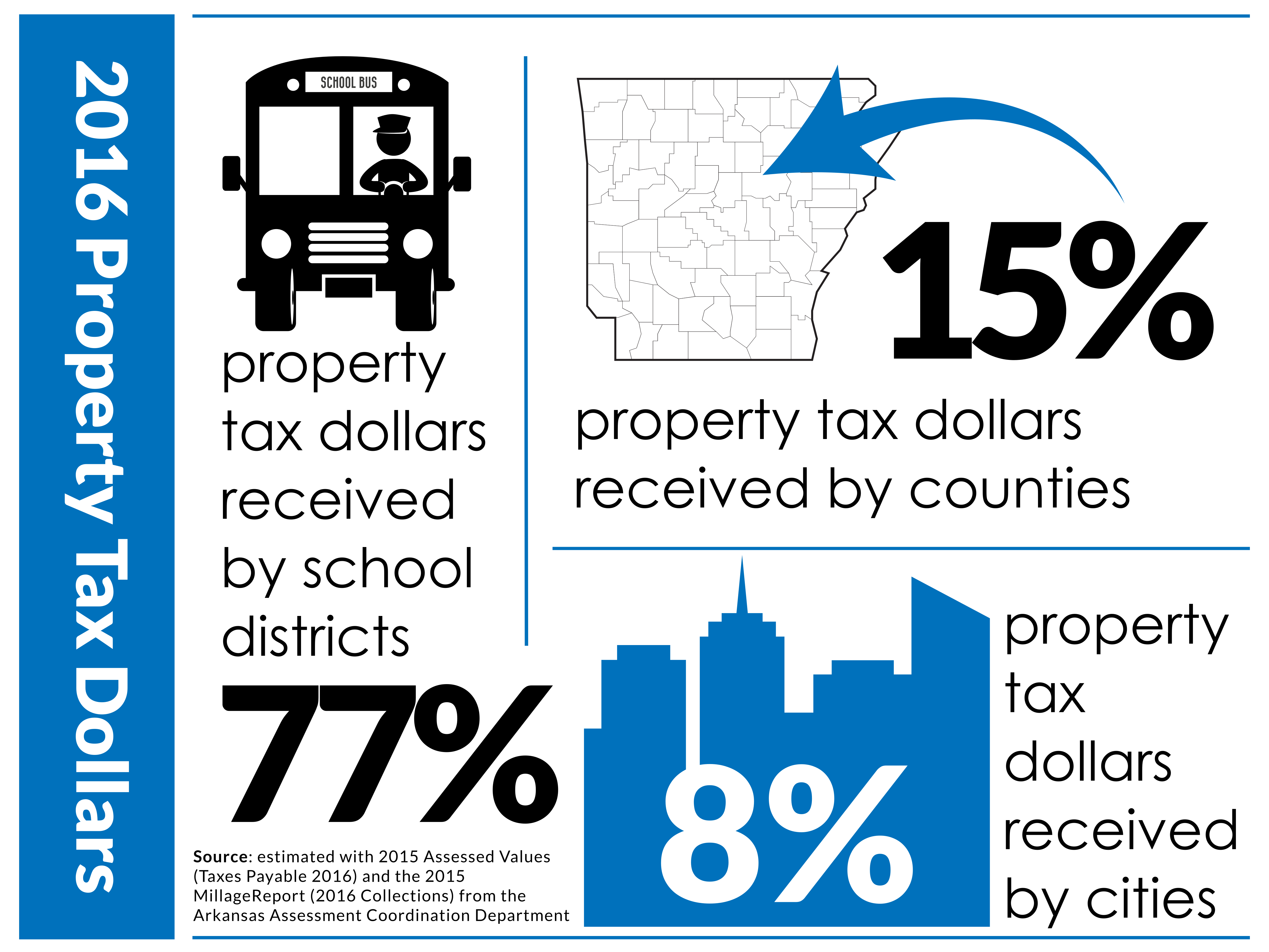

Of all taxes collected in Arkansas state and local combined 181 percent comes from property taxes.

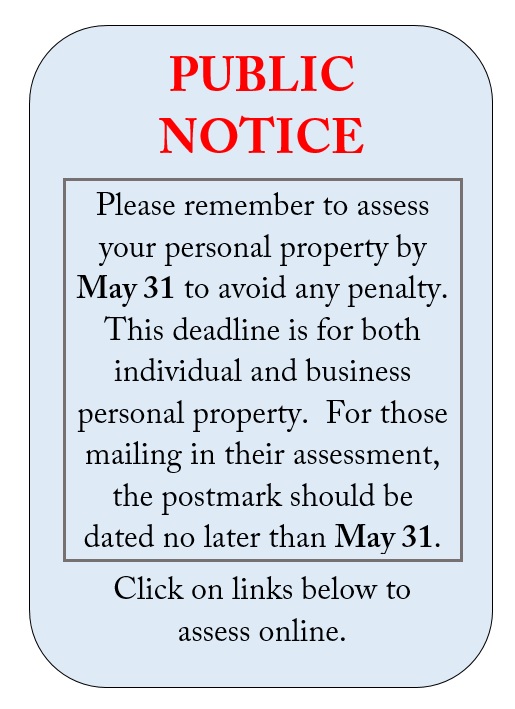

. Want to avoid paying a. A 1 All taxes levied on real estate and personal property for the county courts of this state when assembled for the purpose of levying taxes are due and payable at the county collectors. In fact only an estimated two out of every 1000 estates owe.

Thats the fifth lowest in the nation where the average is 31 percent and. AR K-1FE - Arkansas Income Tax. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

The amount of taxes due annually is based on the assessed value of the property. Arkansas military retirement pay is exempt from state taxes. Arkansas like other states has what is known as a progressive tax system in which higher income individuals pay a higher percentage of their income in taxes while those with less.

Arkansas Income Tax Range. Arkansas Estate Tax Statute. Online payments are available for most counties.

Fiduciary and Estate Income Tax Forms 2022. In fact only an estimated two out of every 1000 estates owe federal estate tax. AR1002ES Fiduciary Estimated Tax Vouchers for 2022.

Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes. According to Amendment 79 the taxable value cannot exceed. Limit for Other Properties eg commercial vacant or agricultural 5 a year until the propertys full.

Real Estate The Real Property Transfer Tax is levied on each deed instrument or writing by which any lands tenements or other realty sold shall be granted assigned.

Arkansas Military And Veterans Benefits The Official Army Benefits Website

Nwar Estate Planning Business Law Tax Law Attorney Rogers Ar Benton County Attorney Lawyer Law Firm Wealth Solutions Counsel Llp

Arkansas Inheritance Laws What You Should Know

Legal Aid Of Arkansas Inc Jonesboro Ar

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Understanding Your Arkansas Property Tax Bill

Create A Living Trust In Arkansas Legalzoom

Learn More About Arkansas Property Taxes H R Block

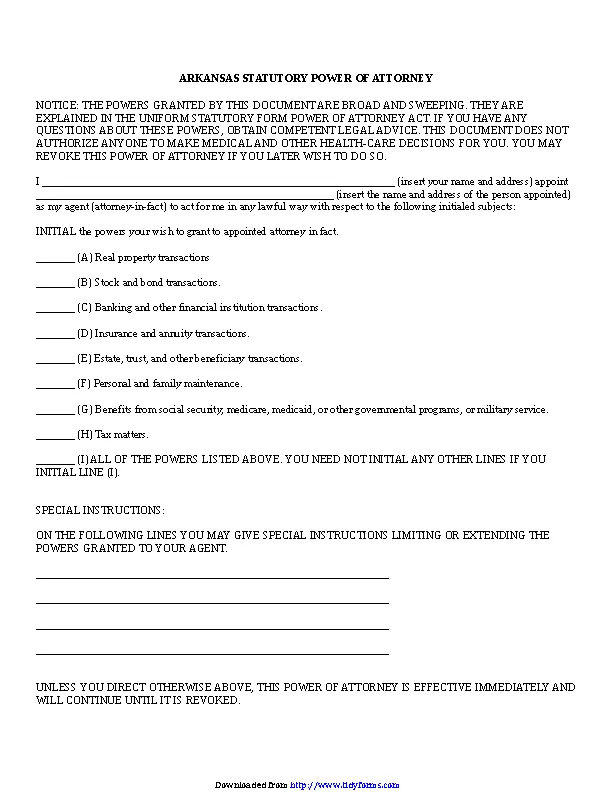

Free Arkansas Durable Statutory Power Of Attorney Form Word Pdf Eforms

Bill Of Sale Form Arkansas Real Property Tax Affidavit Of Compliance Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Pay More Than 10k In Property Taxes Why The Tax Law May Not Be All Bad News Nj Com

Free Arkansas General Warranty Deed Form Pdf Word Eforms

Arkansas State Tax Guide Kiplinger

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

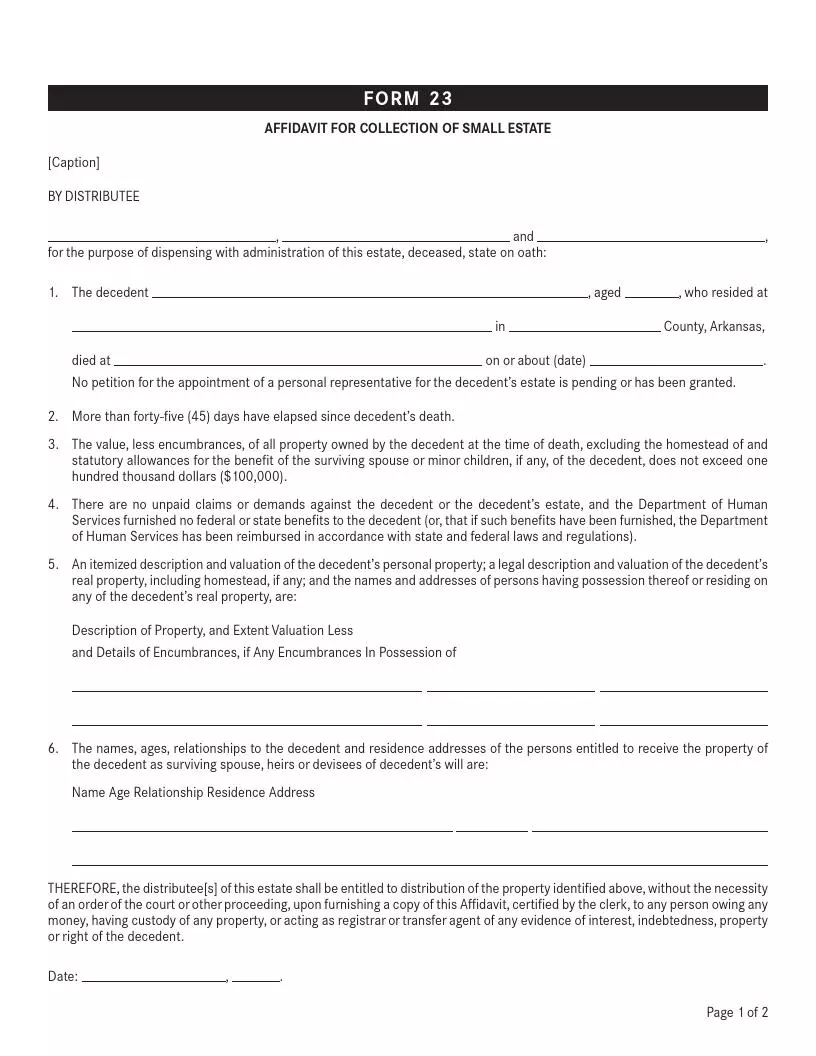

Free Arkansas Small Estate Affidavit Form Pdf Formspal

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group